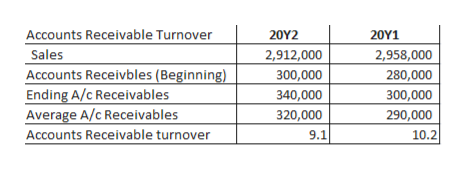

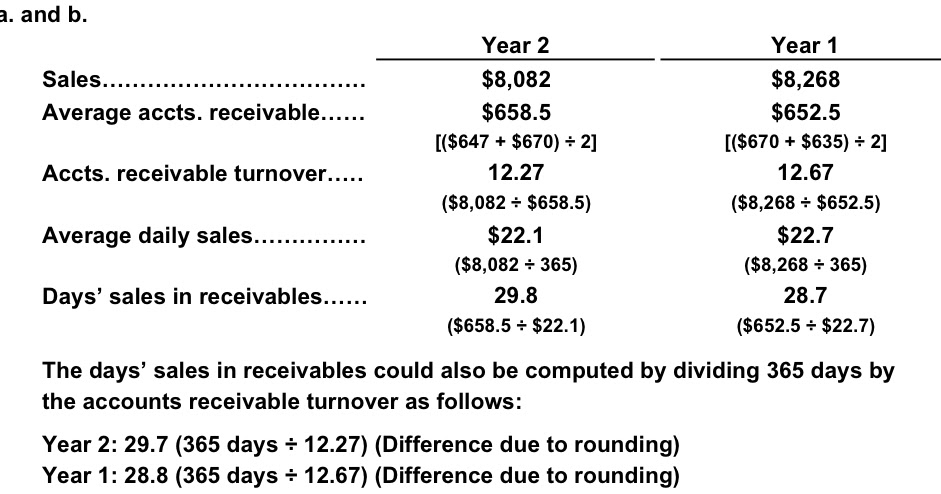

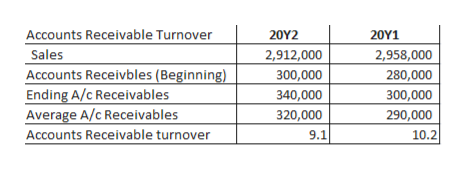

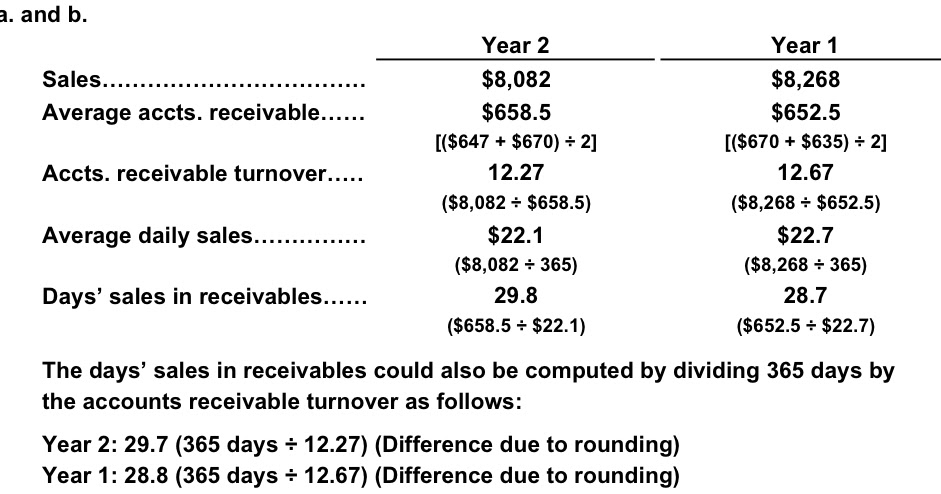

The Meaning of the Accounts Receivable Turnover Ratio So, an accounts receivable turnover ratio of 6 indicates, on average, you are turning over AR every 61 days. Using the example above, conversion to days is: To do this, divide the number of days in the year by the AR turnover ratio to see the average time in days. To get a quick grasp of the ratio, it helps to convert it to days. $150 million / $25 million = 6 AR Turnover Ratio Converting the AR Turnover Ration to Days Accounts receivable at the start of the year was $25.5 million, and at the end of the year, $24.5 million. To illustrate, supposed your company had net credit sales of 150 million last year. So Accounts Receivable Turnover = Net Credit Sales / AR AverageĪR Average =

Average Accounts Receivable ( add two Accounts Receivable totals, from the start and end of the year, and divide by 2 to get your average AR). Net Credit Sales ( all annual credit sales, minus returns and allowances). The AR turnover ratio tells you the number of times your average AR balance turns over in the period measured (typically a year)-how quickly you collect on accounts receivable. The Accounts Receivable Turnover Ratio Formula The Meaning of the Accounts Receivable Turnover Ratio. Converting the AR Turnover Ration to Days. The Accounts Receivable Turnover Ratio Formula. In contrast, a low ratio indicates problems in collections and possibly weak credit policy or review. A high accounts receivable turnover rate demonstrates the efficiency of collections based on adequate credit vetting. The higher the rate, generally, the better. The AR turnover ratio effectively measures the effectiveness of your credit decisions and debt collection. One way to do so is to review your accounts receivable turnover ratio. Rarely if ever, do all customers pay every creditor on time, so finance must keep an eye on accounts receivable turnover. Complexity underlies that simple concept, however. Companies extend credit to customers and expect to get paid within a specified time after shipping their products or delivering their services.

Average Accounts Receivable ( add two Accounts Receivable totals, from the start and end of the year, and divide by 2 to get your average AR). Net Credit Sales ( all annual credit sales, minus returns and allowances). The AR turnover ratio tells you the number of times your average AR balance turns over in the period measured (typically a year)-how quickly you collect on accounts receivable. The Accounts Receivable Turnover Ratio Formula The Meaning of the Accounts Receivable Turnover Ratio. Converting the AR Turnover Ration to Days. The Accounts Receivable Turnover Ratio Formula. In contrast, a low ratio indicates problems in collections and possibly weak credit policy or review. A high accounts receivable turnover rate demonstrates the efficiency of collections based on adequate credit vetting. The higher the rate, generally, the better. The AR turnover ratio effectively measures the effectiveness of your credit decisions and debt collection. One way to do so is to review your accounts receivable turnover ratio. Rarely if ever, do all customers pay every creditor on time, so finance must keep an eye on accounts receivable turnover. Complexity underlies that simple concept, however. Companies extend credit to customers and expect to get paid within a specified time after shipping their products or delivering their services. Accounts receivable turnover in days how to#

Read this blog to understand what it means, how to calculate it, and how to improve it.Ĭredit is a normal part of doing business. There are several important metrics for accounts receivable (AR).

Metrics tell you important information about your enterprise’s performance.

0 kommentar(er)

0 kommentar(er)